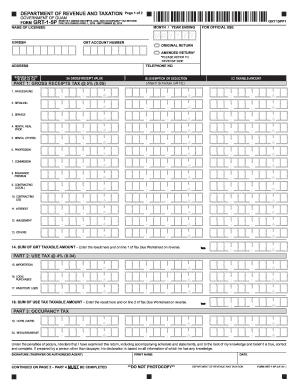

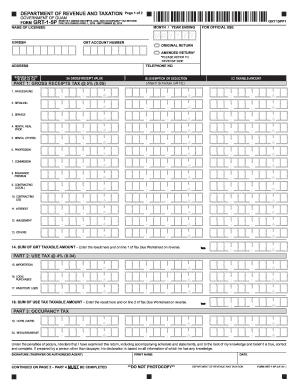

Real estate and rental and leasing services (Code Sec 953.7)Īdditional information can be found at. Financial services, insurance, professional, scientific and technical services (Code Sec 953.6). Private education and health services, administrative and support services (Code Sec 953.4). Accommodations, utilities, arts, entertainment and recreation (Code Sec 953.3). Manufacturing, transportation and warehousing, information, biotechnology, clean technology and food services (Code Sec 953.2). For tax year 2017, the gross receipts tax rates range from 0.05625% to 0.4875%. There are seven different tax rates based on different business activities (see below for a summary of the business activity categories).

The gross receipts tax rates vary depending on the type of business and the annual gross receipts from business activity in the city. For additional information regarding residential landlords, please visit. With respect to the tax year 2017, the small business enterprise thresholds are:Ī lessor of residential real estate is considered a “small business enterprise” if and only if the lessor leases fewer than 4 units in any individual building. Every business with gross receipts of $500,000 or more, or payroll expense of $150,000 or more is subject to filing the annual return. Small businesses are exempt from payment of the gross receipts or payroll expense tax if their payroll expenses or gross receipts in the city are within the “small business enterprise thresholds.” However, small businesses may still be required to file an annual return with the city. Having trustees or directors that meet or reside in San Francisco.Owning an interest in a pass-through entity doing business in San Francisco.

#Gross receipts registration#

Maintaining formation, incorporation or registration documents in San Francisco. Contracting with or acting through the San Francisco services of an unrelated investment advisor. There are exemptions for entities with limited activities within San Francisco, including: Liquidating a business when the liquidator holds itself to the public as conducting a San Francisco business. Exercising corporate or franchise powers in San Francisco. Performing work, solicitation or services in San Francisco, including operating motor vehicles on San Francisco streets in a business activity, for any part of seven or more days of the year. Employing or loaning capital on property located in San Francisco for a business purpose.  Maintaining tangible personal property for sale in San Francisco in the ordinary course of business. Owning, renting, or leasing real or personal property in San Francisco for a business purpose. Maintaining a fixed place of business in San Francisco. A person is considered “engaging in business” if that person (or any employee, representative, or agent of that person) conducts any of the following activities: Who is subject to San Francisco gross receipts tax?Īny person engaging in business within San Francisco is subject to the gross receipts tax. Starting in 2019, businesses will pay only the gross receipts tax. Tax year 2018 will be the last year of the payroll expense tax. Overviewīeginning in tax year 2014, for five years, the San Francisco payroll expense tax rate will be incrementally reduced, and the gross receipts tax rate will be correspondingly increased to allow time to adjust to the gross receipts tax. The Ordinance replaces the existing payroll expense tax on the privilege of doing business in San Francisco with a tax that is based on gross receipts from business conducted within the city. The Gross Receipts Tax and Business Registration Fees Ordinance, or simply “Ordinance,” was approved by San Francisco voters on November 6, 2012.

Maintaining tangible personal property for sale in San Francisco in the ordinary course of business. Owning, renting, or leasing real or personal property in San Francisco for a business purpose. Maintaining a fixed place of business in San Francisco. A person is considered “engaging in business” if that person (or any employee, representative, or agent of that person) conducts any of the following activities: Who is subject to San Francisco gross receipts tax?Īny person engaging in business within San Francisco is subject to the gross receipts tax. Starting in 2019, businesses will pay only the gross receipts tax. Tax year 2018 will be the last year of the payroll expense tax. Overviewīeginning in tax year 2014, for five years, the San Francisco payroll expense tax rate will be incrementally reduced, and the gross receipts tax rate will be correspondingly increased to allow time to adjust to the gross receipts tax. The Ordinance replaces the existing payroll expense tax on the privilege of doing business in San Francisco with a tax that is based on gross receipts from business conducted within the city. The Gross Receipts Tax and Business Registration Fees Ordinance, or simply “Ordinance,” was approved by San Francisco voters on November 6, 2012.

Commercial Property Net Zero Feasibility StudyĬhanges in San Francisco Gross Receipts Tax What to expect for tax season.WebTrust for Certified Authorities (CA).GDPR – General Data Protection Regulation.System and Organization Control Reporting (SOC).

0 kommentar(er)

0 kommentar(er)